Climate change can cause acute natural risks, such as floods and storms; and cause chronic ones, such as disaster or transition risks due to long-term climate change. The two types of risks will both impact corporate development. These impacts are often long term, slow, and barely noticeable. When enterprises are aware of these risks without adaptive measures, they may suffer from asset loss, business interruption, or even the elimination of the entire business model.

According to the National Strategy for Climate Change Adaptation 2035 (NCAS), “adaptation” refers to reducing adverse impacts and potential risks caused by climate change by heightening the risk identification and management of natural ecosystem and socio-economic system, making adjustments, taking full advantage of favorable factors and preventing adverse factors.

For enterprises, “adaptation” can be translated to maintain the basic business functions, reorganize and transform operation methods and structures to respond to climate change, in order to achieve a state suitable for the climate and business. It can be said that climate change brings the challenge of “natural selection” and “survival of the fittest” to the vitality of enterprises. The survival of enterprises depends on their ability to adapt to climate change, that is, business viability, and resilience development capacity compared to the magnitude of climate change. Furthermore, since climate change impacts and risks are significantly regional in nature, effective adaptation actions can reduce the adverse impacts and risks of climate change, which is closely related to enterprises’ sustainable development.

We sample listed central SOEs, the main force of the capital market, and collect their sustainability reports, CSR reports, ESG reports, annual reports and other publicly disclosed documents as research materials. Through the observation of more than 30 dimensions, such as climate governance, climate strategy, climate risk, goals and indicators, we summarize the current status of these enterprises’ response to climate change, and explore their management logic and strategic choices on climate change adaptation.

1

Observation 1

Dedicated climate management not yet on the agenda of enterprises

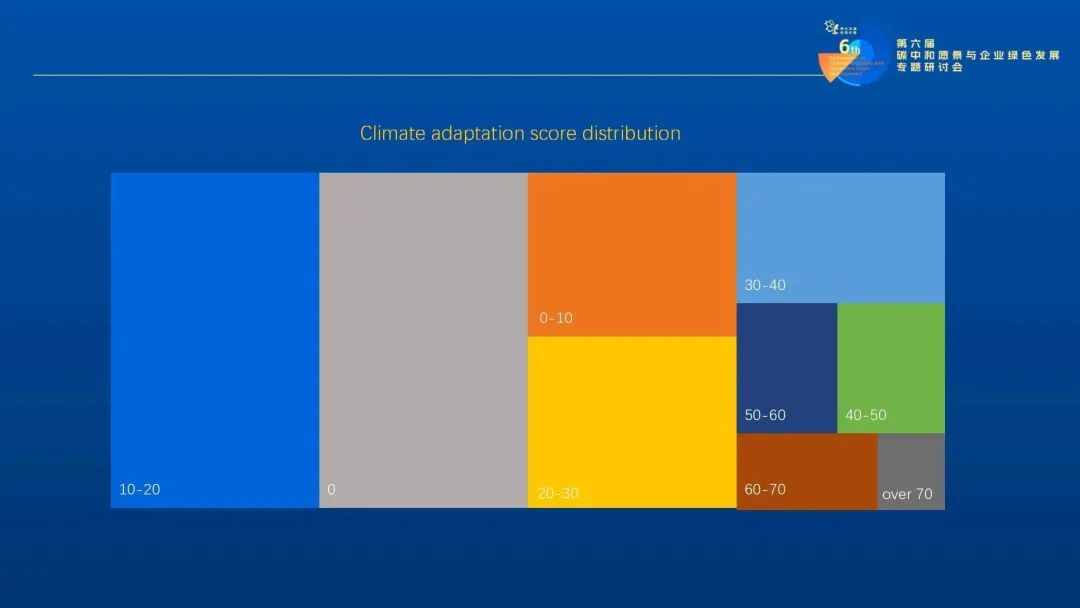

We found that the corporate management on climate change adaptation is still in its infancy.

For nearly a quarter of the enterprises, we did not find their measures on climate change adaptation, which means they are unaware of this issue. More than half of the enterprises are weak in the management of climate change adaptation, and dedicated climate management is not yet on their agenda.

About 10% of the enterprises show adequate preparation for climate change adaptation, they manage climate change systematically, with a balanced effort in terms of governance, strategy, risk and targets, which shows that climate change adaptation is not a technical or a local issue, but a strategic one. Only if the managerial level takes this seriously and manages it systematically from a strategic level, will the overall corporate climate adaptation capability be effectively improved.

2

Observation 2

Low risk identification rate

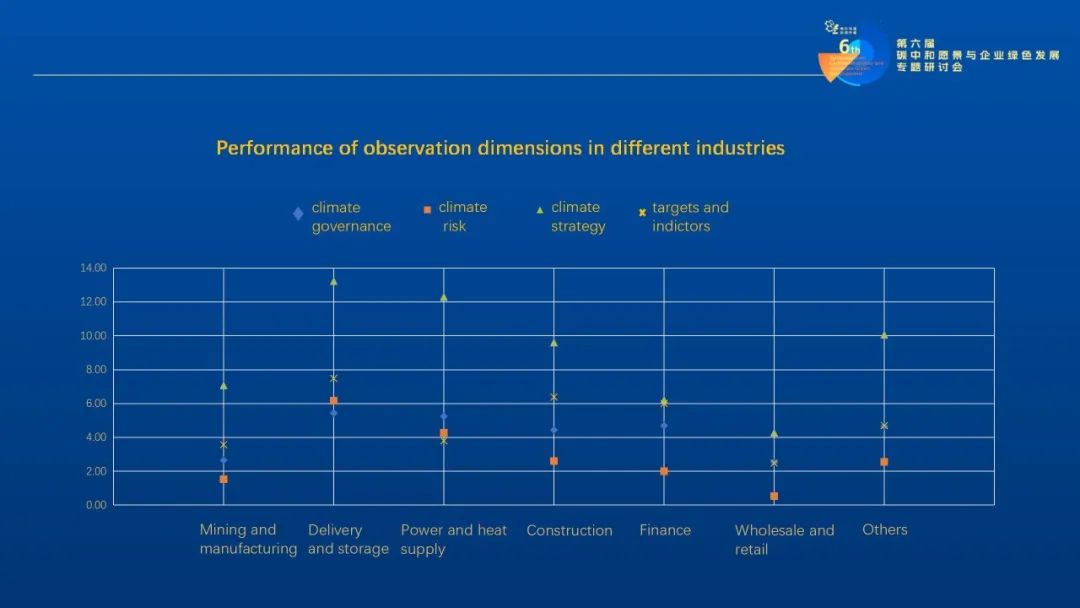

The graph above shows that the risk identification rate is generally low across industries. Even in highly climate-sensitive industries, their risk management scores rank behind other dimensions. Identifying climate change risks is a prerequisite for climate change adaptation. The low risk identification rate ensues severe underestimation on these risk and no follow-up management measures are taken by enterprises.

It’s the reason why the management of climate change adaptation in enterprises is currently at the beginning. Only when enterprises have done the necessary risk identification and assessment work, such as carbon inventories, scenario analysis, and stress tests, and clearly understand the impact of climate change, the magnitude of the risk, and the interaction between climate change risk and business, will they be motivated to take corresponding actions.

3

Observation 3

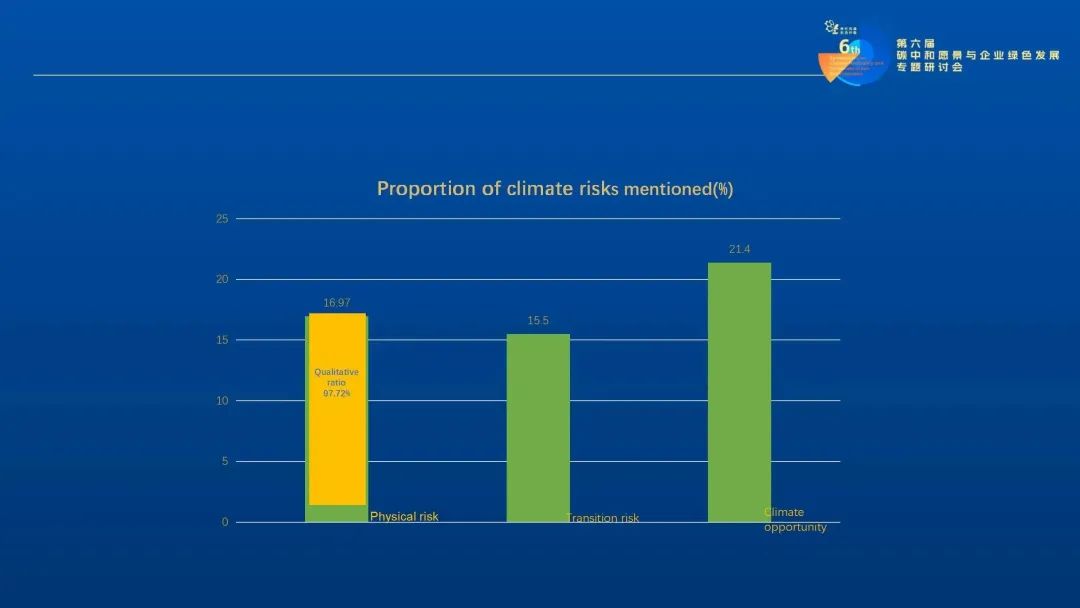

Climate risk identification and management still at the qualitative level

The data shows that nearly 17% of enterprises have noticed physical risks, 15.5% are concerned about transition risks, and more than 21% have expressed their grasp of climate change opportunities. Regarding risk management, the vast majority of enterprises still remain at the level of qualitative analysis. They do not assess clearly how much impact climate risks have on their finances, nor do they incorporate climate risks into their daily operational risk control system for regular management. There is an urgent need for enterprises to deepen their awareness of climate risk management and strengthen related initiatives.

Enterprises are willing to disclose where they have leveraged opportunities. However, such disclosure is still at the qualitative level, reflecting the lack of ability to assess the negative or positive financial impacts of climate change.

Because the threats posed by climate change directly or indirectly to natural ecosystems and economic and social systems are complex, wide-ranging and far-reaching, it is indeed difficult to analyze the quantitative impact of climate change on enterprises by relying only on their own resources. We need the support of forward-looking judgments, models and databases from professional institutions such as the World Resources Institute, the International Energy Agency and the Ministry of Ecology and Environment of China etc.

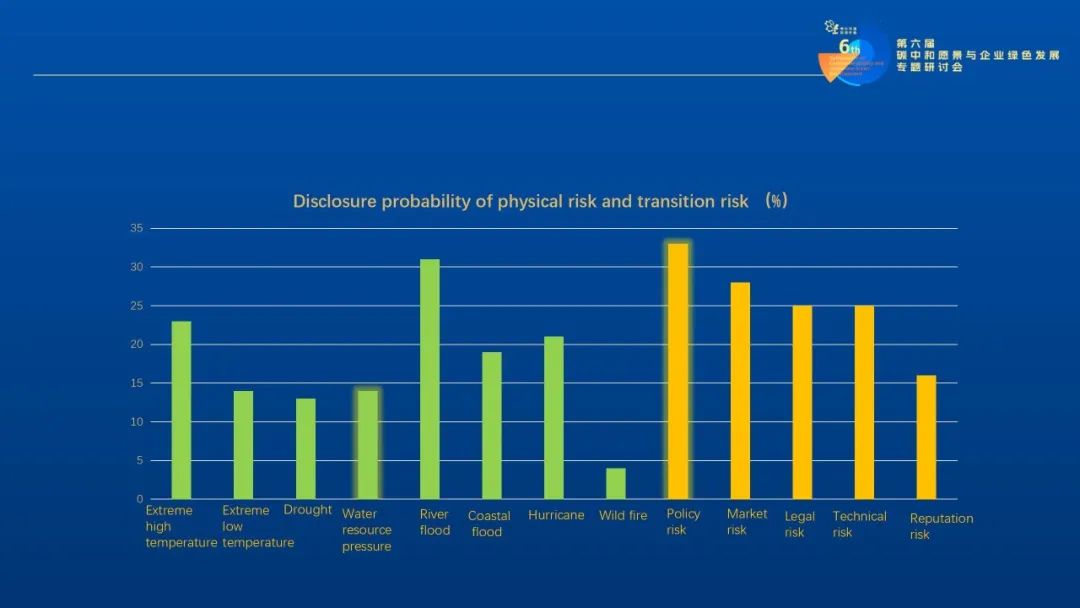

For physical risks, enterprises do better in water stress for risk quantification, they generally use the World Resources Institute’s water stress model to identify three states in the future risk level of the enterprise operation site, including the current, optimistic and unconstrained state. They disclose project quantities and project investment capital affected by different risk levels. Such open-source shared models gives great help to enterprises in quantifying risk.

By subdividing transformation risks, listed central SOEs have the highest degree of policy risk identification and management, which may be related to their nature, but the main reason is that the policy risk is more binding and the cost of carbon price is easier to be perceived and foreseen.

Our study reveals that some foreign enterprises have tried this method: based on the National Independent Contribution Program (INDC), use the market capitalization percentage to break down the autonomous contribution target to the industry and then to the enterprise, calculate the amount of emission reduction and the risk faced by individual enterprises, which is a simple and convenient but well-documented path.

4

Observation 4

Emphasis on emission reduction, not climate change adaptation

Although enterprises are not well prepared for climate management, but from systematic response measures, 34% of them disclose relevant policies and 71% of them have started to take actions. Perhaps they are forced by the external environment, such as China’s 30·60 Decarbonization Goal, policy guidance, and market competition, enterprises attach great attention on climate change.

In terms of mitigation measures, enterprises prefer to control by themselves, such as optimizing process equipment and improving energy efficiency with direct cost reduction and efficiency increase. They are less willing to take actions requiring cooperation with external parties to generate certification of trading practices. While it is important to take mitigating measures, as the effects of climate change are increasing each year, enterprises must focus on adaptive measures for inevitably changing external development environment.

China’s National Plan on Climate Change (2014-2020) has put forward the principle of “placing mitigation and adaptation on equal footing”, but most enterprises fail to identify the relevant risks, and haven’t realized what they should adapt to and how they should act.

5

Observation 5

No link to the corporate financial data

In terms of targets and indicator performance, climate adaptation efforts are not yet linked to executive compensation and performance, nor to financial data, so climate management is not yet close-loop. Without a clear direction, there is a lack of synergy in response measures with no double bonus. Furthermore, internal carbon pricing is often neglected, causing certain revenue loss.

6

Observation 6

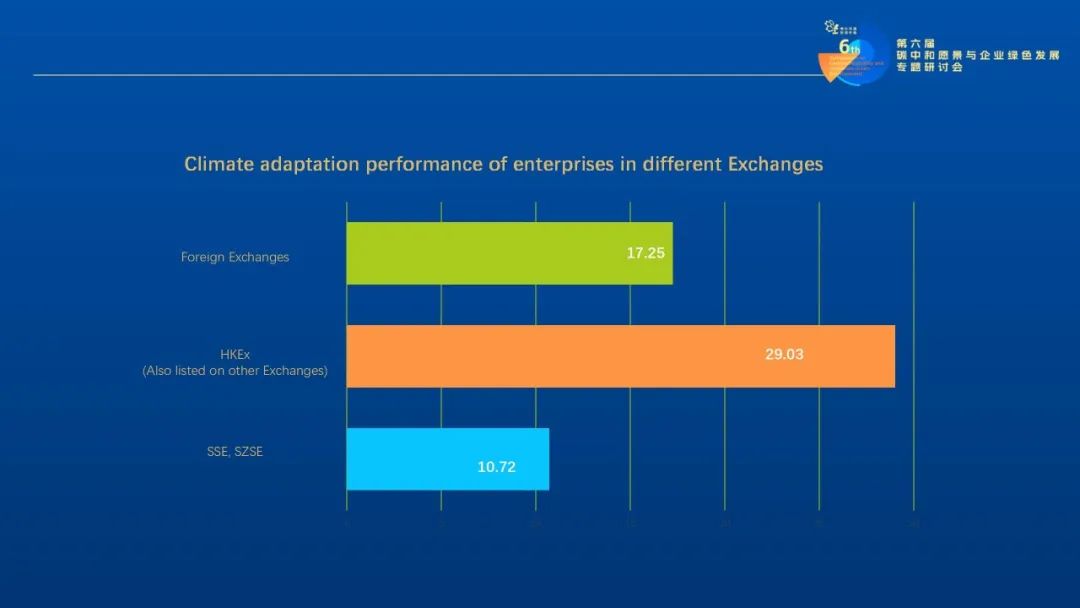

The guiding role of Exchange regulation

External regulation plays a crucial role on these phenomena. By comparing the data, enterprises listed on the Hong Kong Exchanges (HKEx) perform better in climate resilience. According to the Guidance on Climate Disclosures published by the Stock Exchange of Hong Kong (SEHK), it proposes that enterprises should have clear policy guidelines and indicator disclosure requirements in response to climate change. It also requires enterprises to disclose their climate risk management measures in accordance with the TCFD framework by 2025. These have prompted enterprises listed on the HKEx to start acting to meet the disclosure and its regulatory requirements.

7

Observation 7

Climate-sensitive industries first

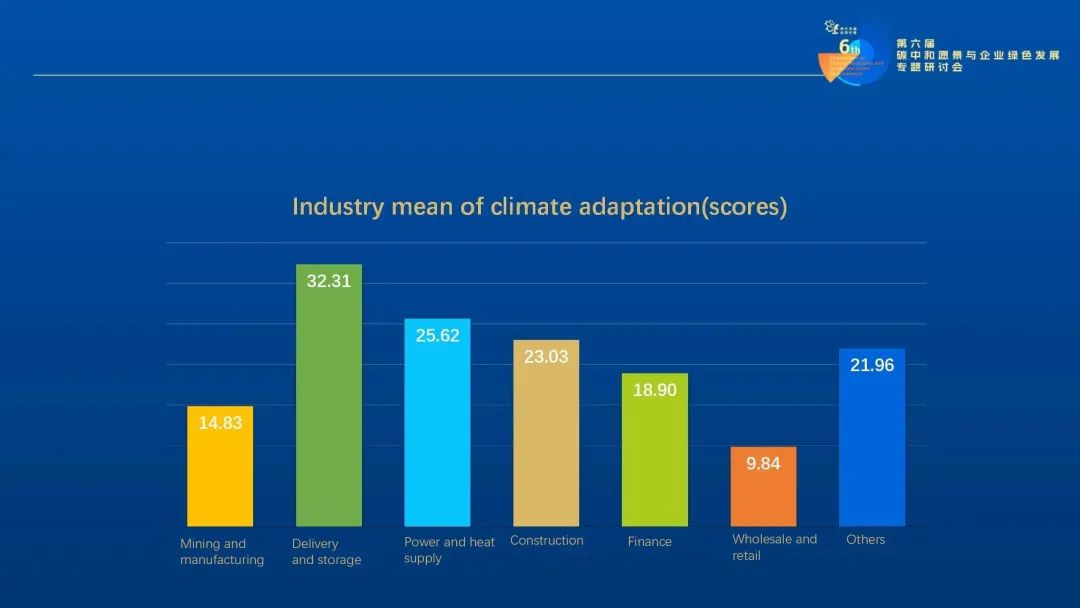

The mean value of climate adaptation ability from different industries shows that the level of climate resilience is more correlated with vulnerability, and climate-sensitive industries are more positive and better prepared, moving faster in climate change adaptation.

Summary

Resilient growth for sustainable development

Through the above observations, we can answer the question that enterprises linger over. That is, why do authoritative standards require enterprises to disclose climate information in ESG or sustainability reports? They are actually guiding enterprises to face climate change, take positive actions, and push them to embed climate-related disclosure into their management and business logic to achieve sustainable development.

1. Adaptation to climate change is a matter of business and is closely linked to an enterprise’s operating model and cost-benefit, and the level of adaptation affects the enterprise’s financial performance.

This is something that we can really feel in our daily lives. For example, when asphalt pavement starts to melt due to high temperatures, road maintenance and safety problems arise; cash crop yields are reduced due to drought; wind turbines are shut down due to increased windless days. It is reported that floods in Henan Province may lead to insurance claims totaling up to 11 billion yuan, behind these phenomena are the economic costs that each enterprise has to pay, and the level of climate adaptation has effectively affected the financial performance of the enterprise.

2. Adaptation to climate change is often ignored by enterprises. Mainstream standards are actively guiding enterprises to pay attention to climate change and quantify climate risks and opportunities in financial data, so that they can clearly understand the materiality of climate change issues.

Although COP26 and COP27 have kept the goal “keep within 1.5°C” alive, and global action to mitigate climate change is promising, higher temperatures, more violent storms, and more unpredictable precipitation have become a reality, enterprises need to consider how to adapt. Mitigation and adaptation are the two main strategies to address climate change, and they are complementary to each other.

3. Adaptation to climate change is not a issue that just a department should concern. It is a corporate behavior, naming a systematic management from governance, strategy, risk to indicators and targets.

For enterprises, adaptation to climate change is not a task that can be accomplished by one person, one department or one period of time because of its complexity, but a task that needs to be planned based on whole enterprise. We hope that all enterprises can identify risks, adapt to changes, overcome vulnerabilities, grow resilient, develop vitally and build a climate-adaptive society together!

Author: He Yang, Senior Director of ESG Consulting and General Manager of Shanghai Office, GoldenBee Consulting

This article is based on the author’s keynote speech at the 6th Symposium on Carbon Neutrality and Corporate Green Development “Accelerating Action on Climate Change Adaptation”.

Back

to top

Back

to top