Recently, Yi Huiman, Chairman of China Securities Regulatory Commission (CSRC) said at Financial Street Forum 2022 that it is necessary to deeply understand the distinctive Chinese elements and characteristics of the development stage embodied in the market system and mechanism, the industrial structure, and the sustainability of the entity. We should dive into the applicable scenarios of mature market valuation theories, grasp the valuation logic of different types of listed companies, and explore the establishment of valuation systems with Chinese characteristics, better leveraging the role of market resource allocation.

Based on relevant requirements and discussions, Yin Gefei, Chief Expert of GoldenBee ThinkTank and Academic Committee Member of China Sustainability Tribune, said that integrating the ESG (environmental, social and governance) into investment decision meets the requirements of the valuation system with Chinese characteristics, which is harmonious coexistence between man and nature, common prosperity for all, and material and cultural-ethical coordination. ESG investment and financing is the engine for developing ESG. If financial institutions fail to properly integrate ESG into their investment and financing activities, such engine will not work and other activities will not develop accordingly.

At present, the biggest challenge for this ESG investment and financing "engine" is that the quantity and quality of ESG data cannot meet its needs as the "fuel". The "ESG net value" is to monetize the value of ESG, featuring a new concept for ESG investment and financing market. If earnings per share and ESG net value per share are added together, the TrueValue of each company per share will be obtained. It is of great value for promoting sustainable investment and financing and sustainable transformation of enterprises.

ESG conforms to the development of valuation system with Chinese characteristics

In recent years, ESG sees a "fast" and "popular" development. According to the data from the UN Principles for Responsible Investment (UNPRI), in 2021, the global asset involving ESG investment has exceeded USD 121 trillion, an increase of more than 17% compared with USD 103.4 trillion in 2020. As of June 30, 2022, 103 organizations from the Chinese market have signed the Principles for Responsible Investment (PRI). From 2020 to 2021, the number of PRI signatories in China increased by 46%, making China the fastest growing market.

ESG is in line with the development direction of valuation system with Chinese characteristics. The valuation system with Chinese characteristics should reflect the requirements of Chinese modernization, serve the development of Chinese modernization, promote the allocation of corporate resources aligning with Chinese modernization, and better play the role of capital market in boosting Chinese modernization. To build a valuation system with Chinese characteristics, we should follow the basic principles that are conducive to common prosperity, the material and cultural-ethical advancement, the harmonious coexistence of man and nature, and the path of peaceful development.

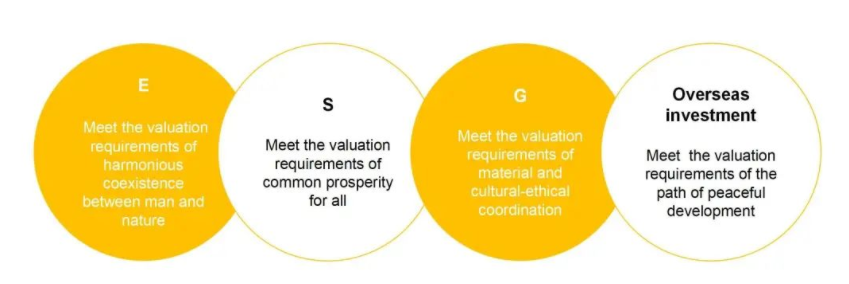

The essence of incorporating ESG into investment is to revise and optimize the current valuation system for financial and economic value consideration. To consider environmental, social and governance factors in ESG investment valuation respectively meets the requirements of the valuation system with Chinese characteristics, which is harmonious coexistence of human and nature, common prosperity for all, and material and cultural-ethical coordination. Adherence to the ESG investment valuation concept in overseas investment meets the requirements of the valuation system with Chinese characteristics, which follows the path of peaceful development.

Meanwhile, ESG investment development is challenged by valuation and digitalization. On the one hand, the scale of fund management under 7 ESG investment strategies in the investment market is growing rapidly, while the investment valuation system based on financial value has not been fundamentally changed, which cannot fully reflect and respond to the requirements of the valuation system with Chinese characteristics.

On the other hand, ESG investment is also facing the challenge of weak digitalization, and financial institutions have difficulties in obtaining data for these investment and financing objects. Specifically, first, the current ESG evaluation method is difficult to reflect the real corporate ESG value. Second, non-financial ESG cannot measure the value increase or decrease of asset externalization. Third, investors need timely and dynamic ESG data to make investment decisions.

Explore the quantification of ESG value

First, Shanghai Stock Exchange (SSE) put forward "social contribution value per share" in 2008. On the basis of reviewing earnings per share, it paid attention to the value added per share created by the enterprise for the society, and took the lead in establishing a comprehensive stakeholder perspective on corporate value creation.

Second, some organizations use methods of Task Force on Climate-related Financial Disclosures (TCFD) / Taskforce on Nature-related Financial Disclosures (TNFD) / International Sustainability Standards Board (ISSB) in combination with the income approach, market approach and asset-based approach to explore the inclusion of ESG into the investment valuation model. Internationally, from climate-related financial disclosure, such as TCFD, to nature-related financial disclosure, such as TNFD, to sustainability-related financial disclosure, such as General Requirements for Disclosure of Sustainbility-related Financial Information issued by ISSB, the disclosure requirements for assessing the impact of sustainability on financial value have developed rapidly from topics to full dimensions, showing a trend of constantly in-depth exploration of the financial ESG revised valuation model.

Third, research and develop ESG net value accounting methods. GoldenBee ThinkTank has been committed to the quantitative research of ESG value in recent years, and has brought forward the concept of "ESG net value". Through the monetized value of risks or opportunities of ESG factors by financial values, the difference between corporate external influence and the industry's average influence intensity will be analyzed. A monetized indicator, namely an enterprise’s ESG net value will be summarized. It provides investors with new reference indicators to understand the ESG performance of an enterprise.

For example, the E (environmental) in ESG mainly involves the CO2 emitted by enterprises, and its value can be calculated. In principle, the CO2 emitted by an enterprise should be a potential cost. How to measure the value and cost of its carbon? We suppose these are measured by the sector's average value. If the emission level of an enterprise is higher than the average level of the sector, it is equivalent to externalizing a higher cost than the average cost. If it is lower than the average cost, it is the relative value that is externalized. This is exactly the value and cost of externalization concerned by financial institutions, that is, the monetization of risks and opportunities.

It can be further analogized to a formula: ESG net value = externalized value - externalized cost = positive environmental impact - negative environmental impact + positive social impact - negative social impact. Then, it can be used to measure whether an enterprise's ESG is a risk or an opportunity. Unit ESG net value = ESG net value / net assets (or total equity), which is the unit (per share) ESG net value. Measured by such formula, non-financial ESG factors can be expressed in a financial way, which solves the key problems that some ESG data belonging to financial institutions are not intuitive, can not be measured, can not be effectively compared, and the investment results can not be effectively measured.

Digitalization empowers the quantification of ESG value

The quantification of ESG value has the needs and characteristics of non-standard, timely, mass data storage and computing operation. Digital technology and platform can effectively support quantification, analysis and output of results, satisfying the investment needs of the capital market. For example, using automatic data collection when collecting the data. The structured data processing is used to ensure quality control. Finally, timely and large-scale services for ESG data can be provided.

To satisfy the demand of investors, GoldenBee ThinkTank has developed a digital tool for corporate ESG value, that is, OneESG platform. It is convenient to know the ESG net value of the enterprises collected, and even calculate the price earnings ratio (PER) and comprehensive PER of ESG.

The OneESG platform is a new direction for enterprises and a new concept for the entire capital market. If we add up earnings per share and ESG net value per share, we can get the real vdalue of the enterprise. In the future, the calculation of investment is not only the Price Earnings Ratio (PER) calculated according to the financial data, but also the ESG PER, and the comprehensive PER of the enterprise. Then, investment activities will be economically, environmentally, and socially feasible, that is, sustainable investment. It is valuable for promoting the transformation of enterprises to sustainable development and building a sustainable society.

Written by Yin Gefei, Chief Expert of GoldenBee ThinkTank, Academic Committee member of China Sustainability Tribune

Back

to top

Back

to top